Crypto Payouts

This guide details a step-by-step implementation of Crypto Payouts.

Introduction

This guide outlines the steps to make a USDC payout to a crypto wallet using the Pockyt Payments API. The payout process supports wallets across multiple blockchain networks. The workflow involves registering the payee, configuring their wallet, and executing the payout transaction. For other configurations, payout methods, and currencies, please contact the solutions team at [email protected] to get setup.

Prerequisites

- Merchant Account Setup – Ensure the merchant has an active Pockyt account.

- API Credentials – Obtain

merchantNo,storeNovalues from Pockyt.- Webhook Configuration – Set up

ipnUrlto receive transaction status updates.- Regulatory Compliance – Merchants must adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. It is important that the merchant has been approved by Pockyt's compliance team for this service. If you have any questions, reach out to [email protected] or contact your sales representative.

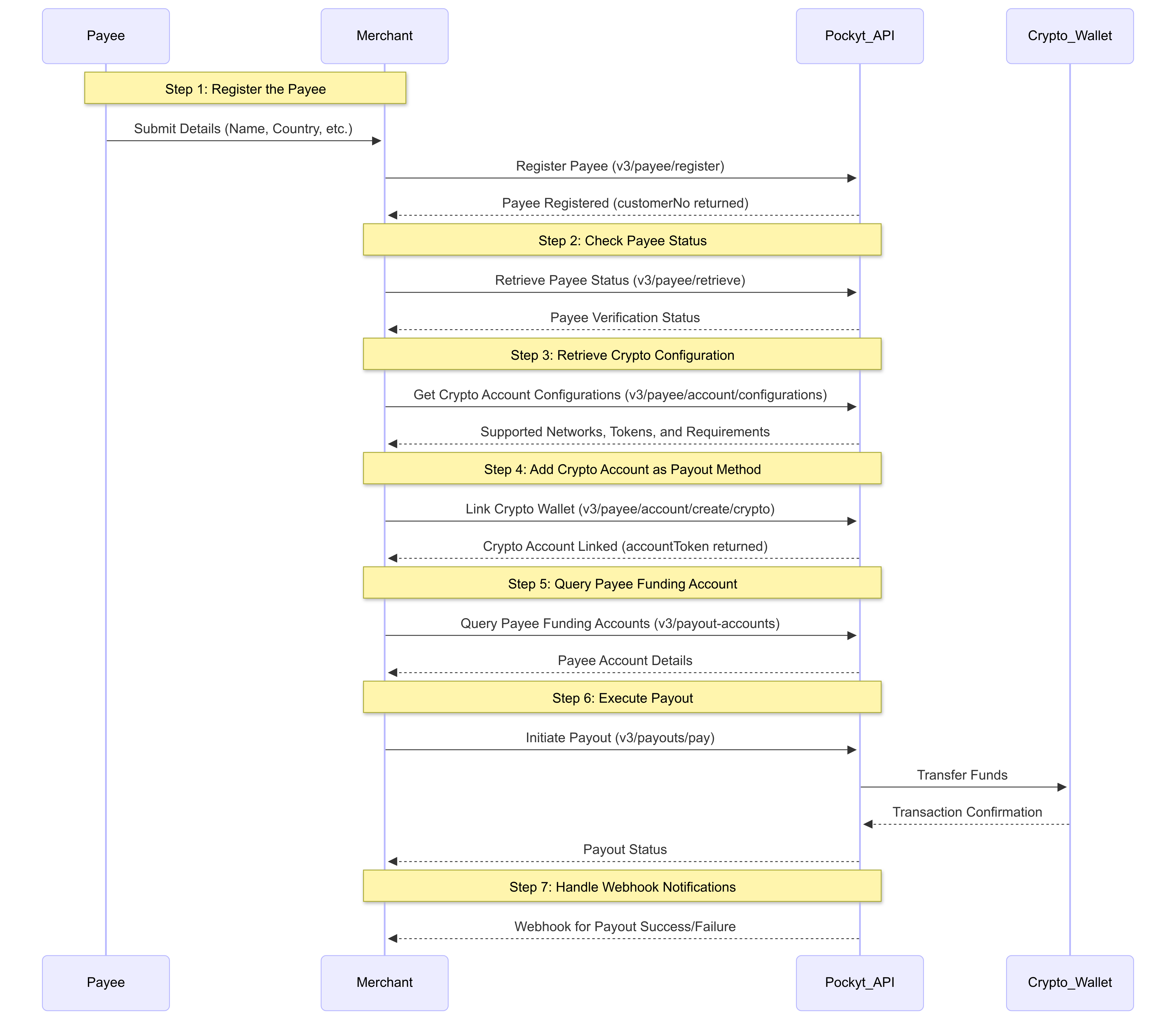

API Workflow

Step-by-Step Breakdown of the Payout Workflow

API References for Workflow Steps

- Step 1: Register Payee /v3/payee/register

- Step 2: Check Payee Status /v3/payee/retrieve

- Step 3: Retrieve Crypto Configuration /v3/payee/account/configurations

- Step 4: Add Crypto Account as Payout Method /v3/payee/account/create/crypto

- Step 5: Query payee funding account /v3/payout-accounts

- Step 6: Execute Payout /v3/payouts/pay

- Step 7: Handle Webhook Notifications

Step 1: Register Payee

Action: The merchant registers a payee in Pockyt’s system to generate a customerNo. This identifier is required for all subsequent payout steps.

Key Considerations:

- The

profileType(INDIVIDUAL or BUSINESS) determines the required fields. - The payee’s email and governmentId must be unique.

- The

customerNoreturned here is needed in Step 5 and Step 6.

Step 2: Verify Payee Status

Action: Query the /v3/payee/retrieve endpoint to confirm if the payee is ACTIVATED for payouts.

Key Considerations:

- If the status is PENDING, the payee may be under additional compliance review.

- If the status is DECLINED, additional documents may be required.

- Payee status can change dynamically based on compliance requirements, so always check status before payouts.

Step 3: Retrieve Crypto Configuration

Action: Call /v3/payee/account/configurations to retrieve required parameters for linking a payee’s crypto account.

Key Considerations:

- This is a data service for developers, ensuring they retrieve the most up-to-date crypto requirements for different countries and currencies.

- Pockyt provides this service so developers always have access to the correct fields needed to register a payee’s crytpo account without requiring manual updates.

Example API Response:

{

"status": 200,

"resultBody": {

"total": 1,

"ret_msg": "succeeded",

"results": [

{

"profileType": "INDIVIDUAL",

"accountType": "CRYPTO",

"accountCurrency": "USDC",

"accountCountry": "ZZ",

"fields": [

{

"isRequired": true,

"possibleValues": [

"ALGO - Algorand",

"ARB - Arbitrum",

"AVAX - Avalanche C-Chain",

"BASE - Base",

"CELO - Celo",

"ETH - Ethereum",

"HBAR - Hedera",

"NEAR - NEAR",

"NOBLE - Noble",

"OP - OP Mainnet",

"PAH - Polkadot Asset Hub",

"POLY - Polygon PoS",

"SOL - Solana",

"XLM - Stellar",

"ZKS - ZKsync Era"

],

"minLength": 2,

"name": "walletChain",

"label": "Chain",

"maxLength": 16

},

{

"isRequired": true,

"minLength": 1,

"name": "walletAddress",

"label": "Wallet Address",

"maxLength": 255

},

{

"isRequired": false,

"minLength": 1,

"name": "walletAddressTag",

"label": "Memo",

"maxLength": 64

}

]

}

],

"ret_code": "000100"

}

}- The fields in this response provide the necessary parameters to register a payee crypto account.

- Required fields (e.g.,

walletChain,walletAddress,) must be extracted and included in the request body of Step 5. - Different jurisdictions may require additional fields, so developers should always query this endpoint before submitting crypto account details.

Step 4: Add Crypto Account as a Payout Method

Action: Register the payee’s crypto account using /v3/payee/account/create/crypto.

Key Considerations:

- The

customerNofrom Step 1 is required in this request. - The response returns an

accountToken, which serves as the payment token for this payout method. - This

accountTokenmust be included in Step 6 to execute the payout. - Example accountToken:

2010378298556879970563

Step 5: Query Payee Funding Account

- **Action:**The Merchant Backend calls the Query Payee Funding Accounts API to retrieve the payee’s payout accounts. This helps you check his account status.

- Endpoint:

POST /v3/payee/payout-accounts - Key Parameters:

- Query Parameters:

accountToken(optional) – if provided, retrieves details of the specific account associated with the token; if omitted, returns all accounts linked to the payee.

- Response: Returns the list of payout accounts associated with the payee.

- Query Parameters:

Step 6: Initiate Payout Transfer

Action: Execute a payout to the payee’s crypto account via /v3/payouts/pay.

Key Considerations:

- The

customerNofrom Step 1 and theaccountTokenfrom Step 5 are required. - Ensure

amountdoes not exceed the merchant’s available balance. - The

invoiceIdshould be unique to avoid duplicate payouts. - The

ipnUrlis critical for receiving transaction updates. - This API request only confirms Pockyt received the payout request—it does not confirm that the funds have been deposited.

- The actual payout status must be checked via webhook notifications, as crypto transactions process asynchronously.

Step 7: Handle Webhook Notifications

- Action: The webhook is triggered once the customer accepts the billing agreement in the checkout UI. However, the payment method has not been charged yet.

- Purpose: The webhook contains the transactionNo, which is required for charging the payment method in the next step via the /process API. It also includes the vaultId, which should be saved for future use, though it is not fully activated until the /process API is called.

- See Example Webhook Notification Body Here

Key Considerations:

- The initial API response in Step 6 does not confirm that the payout has been completed.

- Webhook notifications will indicate whether the payout is pending, successful, or failed.

Key Notes for Implementation

-

Parameters Flow:

customerNo: Generated in Step 1, used in Steps, 4, 5 and 6.accountToken: Generated in Step 4, required in Step 5 and Step 6 to execute the payout.transactionNo: Generated in Step 6, used in Step 7 for webhook tracking.

-

Payout Processing Logic:

- The actual fund transfer time depends on Crypto Network processing times.

- Merchants must always rely on webhook notifications (Step 7) for final payout confirmation.

-

Webhook Notifications:

- Webhook notifications are crucial for confirming the status of transactions in Step 7.

- Ensure the Webhook Listener processes the

transactionNoand status fields properly to track payout completion.

For additional assistance, contact [email protected].

Updated 4 months ago